We build strength, stability, and self-reliance through shelter

Every day, families partner with Habitat for Humanity to build homes and, as a result, better lives. Over the course of their journey, each family invests hard work and dedication on an intensive path to homeownership. From attending homeowner courses to completing sweat equity hours, each step empowers future homeowners and helps create the access and foster the skills they need to succeed.

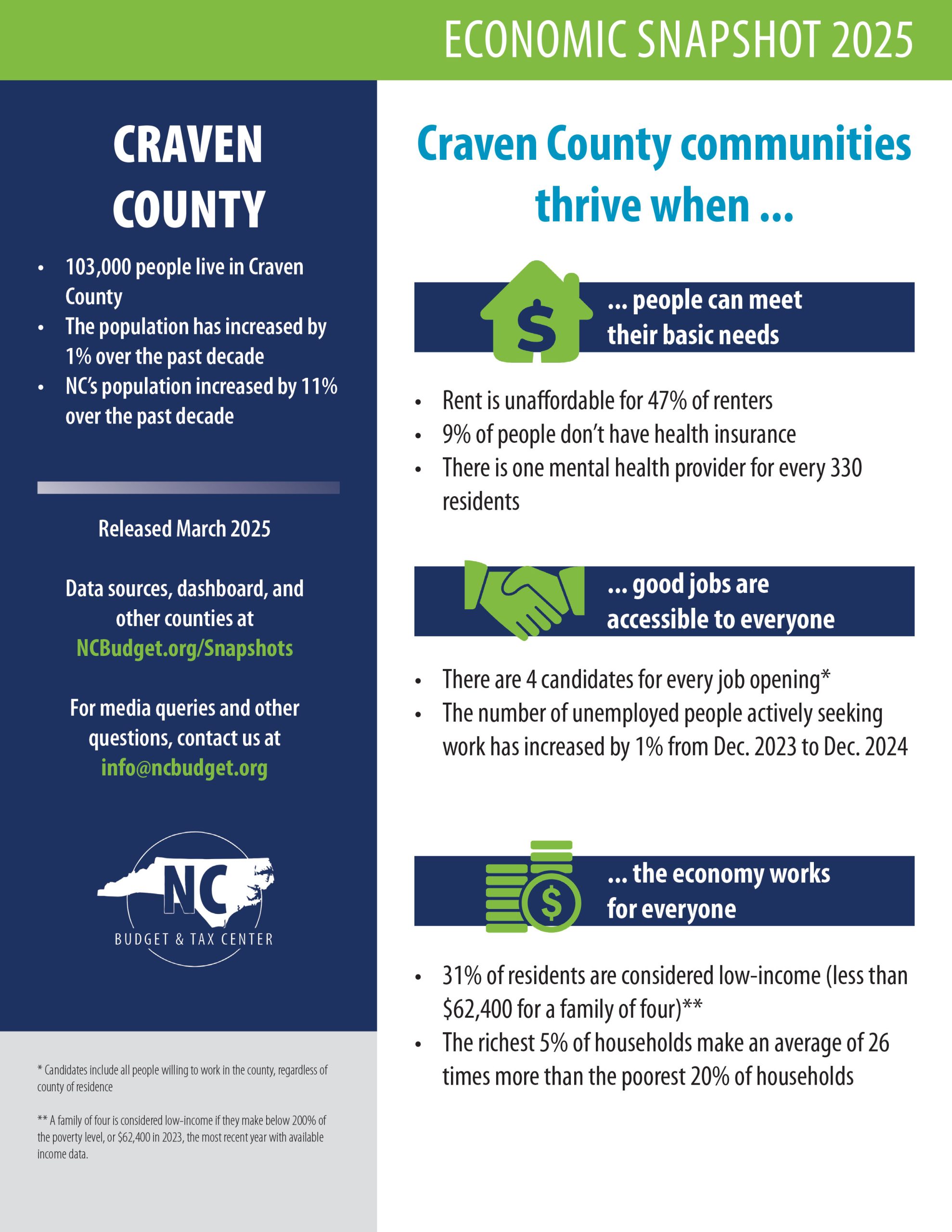

Consider purchasing a home through Habitat for Humanity of Craven County. We build and finance 2, 3, and 4-bedroom energy-efficient homes. Qualified homeowners pay an affordable monthly 0% interest mortgage that is equal to or less than 30% of their gross monthly income.

the dream of homeownership is achievable

prospective homeowners must demonstrate:

Basic Criteria:

- Live and/or work in Craven County for at least 12 months currently

- U.S. citizen or legal permanent resident

- Need for housing

- Overcrowded conditions

- Substandard housing

- Cost burdened (paying > 30% monthly gross income for rent + utilities)

- Ability to Repay a Loan:

- STEADY, RELIABLE, VERIFIABLE income for the past year (12 months) + the current year

- 12-months rental history (current)

- 1st time homebuyer

- NO evictions or judgments

- NO unsatisfied judgments

- NO bankruptcies/foreclosures in the past 5 years

- Debt to income ratio must be 30% or less

- Willingness to Partner:

- Contribute 300 sweat equity hours

- Move into areas where currently building

application steps

Attend a scheduled Potential Homeowners Information Session (Closed for the season)

For the next session:

- Follow us on Facebook

- Check back here

In accepting and rejecting applications, Habitat for Humanity of Craven County must conform to all aspects of the Fair Housing Act and all Fair Housing Laws, the Equal Credit Opportunity Act, the Fair Credit Reporting Act, the Privacy Act, the Americans with Disabilities Act, as well as any local applicable laws as they apply to applications for a mortgage.